Okay, let’s analyze this text and extract the key information, focusing on the interplay of financial terminology and the contrasting viewpoints.

I’m going to structure this analysis in sections: Key Financial Terms, Contrasting Views (Agabiti – FdI vs.

the Current Administration), and Overall Themes.

I’m also going to try to reflect the spirit of the original text’s somewhat elaborate phrasing.

1.

Key Financial Terms e Concepts (with Context from the Text):The text is *laden* with financial terminology.

Here’s a breakdown, contextualized by the discussion:* Rendiconto (2024): The financial report or “Account” for the year 2024.

This is the central document being discussed.

* Equilibrio finanziario solido: A “solid financial balance.

” This is presented as a positive achievement by the previous administration.

* Vincoli di bilancio: “Budget constraints.

” Rules and limits placed on spending, mandated by national and European regulations.

The previous administration claims to have *respected* these.

* Avanzo di bilancio: “Budget surplus.

” Money left over after all expenses are paid.

The current administration’s decision regarding this surplus is the *major point of contention*.

* Accantonamento: “Accretion” or “Allocation”.

The act of setting aside funds for a specific purpose.

The current administration’s use of the surplus for this purpose is highly criticized.

* Fondo crediti di dubbia esigibilità: “Fund of credit of doubtful collectibility.

” Funds set aside in anticipation that certain debts might not be repaid.

The criticism revolves around *why* this fund was created and the timing.

* Pareggio di bilancio: “Budget balance.

” The concept of having income equal to expenses.

The prior administration claims to have achieved this without raising taxes.

* Debito (a carico della regione): “Debt (borne by the region).

” The amount of money owed by the region.

The prior administration highlights a reduction in this debt.

* Debito autorizzato: “Authorized debt.

” Debt that has been formally approved for a specific project.

Reduction here is also highlighted as a positive.

* Tassa automobilistica: “Automobile tax.

” A tax on automobiles.

Recovery of this tax is presented as a success.

* Contenzioso (con le province): “Litigation (with the provinces).

” A legal dispute.

Settling this dispute (for 25 million) is presented as a success.

* Saldo positivo: “Positive balance”.

Represents a favorable outcome in financial matters.

* Liquidità di cassa: “Cash liquidity.

” The amount of readily available cash.

Having a healthy level of this is essential for financial stability.

2.

Contrasting Views: Agabiti (FdI – Right-wing) vs.

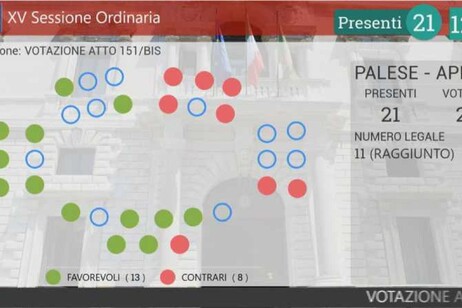

Current AdministrationThis is where the text’s real substance lies.

Here’s a breakdown of the core disagreement:* Agabiti (FdI – Right Wing Perspective): * Praise for the Previous Administration (FdI): She consistently portrays the previous administration as fiscally responsible: solid financial balance, respect for budget constraints, reduction of debt, successful tax recovery, settling legal disputes, and a positive balance.

She emphasizes the *lack* of tax increases during their tenure.

* Criticism of the Current Administration: The current administration is *heavily* criticized for using the entire budget surplus to create a fund for doubtful credit.

She claims this was done to hide the fact that they are raising taxes and engaging in political propaganda.

She questions the timing of the decision and brings up concerns raised by the Corte dei conti (Court of Auditors).

Agabiti suggests the action is deceptive.

* Underlying Theme: Fiscal responsibility requires prudence, transparency, and avoiding deceptive practices.

The current administration is failing on all counts.

* The Current Administration (Implied – through Agabiti’s Critique): * The text *doesn’t directly state* the current administration’s perspective.

However, it’s implied that they believe the fund for doubtful credit is necessary to manage financial risks and may be justified even if it temporarily impacts the surplus.

They likely believe their actions are in the best interest of the region, although Agabiti disputes this.

* They likely view the creation of the fund as a proactive measure rather than a deceptive tactic.

3.

Overall Themes e Tone:* Fiscal Conservatism vs.

Proactive Financial Management: The core conflict revolves around differing philosophies regarding financial management.

Agabiti champions a conservative, balanced approach, while the current administration appears to favor a more proactive, risk-mitigation approach.

* Transparency and Deception: A significant theme is the importance of transparency in government.

Agabiti accuses the current administration of deception and manipulating financial data for political gain.

* Political Posturing: The entire exchange seems steeped in political maneuvering.

Agabiti’s statements are clearly intended to undermine the current administration and highlight the perceived successes of the previous FdI-led government.

* Elaborate and Formal Language: The language itself reinforces the formality of the debate.

The complex phrasing and reliance on technical financial terms create a sense of gravity and seriousness.

To help me refine this analysis, could you tell me:* Is there a specific aspect of the text you’ve been focusing on?* Are you interested in a comparison of the specific financial numbers mentioned?